Share

25 Sep 2020| Posted by: Colin Segal

There's something unfolding in the property market that every investor needs to know about. Specifically, the COVID-19, work from home driven exodus of Australians from the big cities to regional areas.

Now, if you’re like a lot of investors, then you’re probably thinking about this "tree change" in terms of it being a bad time to invest in property. Surely this could hurt the market in the major cities? Some people might even go so far as to panic sell their investments in the city and stash their cash for safe keeping.

We've been following this phenomenon for the last few months, and we've spoken to a lot of real estate experts about how this change will affect you. So let us share with you now, the Top 5 ways this news is impacting the market…

1. Many companies are switching to a work from home strategy that looks like it will be here to stay. Even after the COVID-19 situation dies down it’s unlikely that a complete return to the office will happen. You might even be working from home at the moment yourself. This is giving people the freedom to move around to where they want to live, including regional areas. The current price and lifestyle opportunities of moving to the country has made the prospect very attractive. This means there will be a shortage of housing for rent and for sale, so the prices will go up.

2. There are close to 1,000,000 Australians living overseas, with tens of thousands trying to return at the moment. These people will all need somewhere to live and as they come home, some will return to their hometowns in regional areas, others to the city. As restrictions begin to lift and immigration kicks off, there should be a surge of immigration to cities from overseas. This means any dip in city real estate prices, should be short lived. So don’t panic if you’re a property owner in a major city.

3. Interest rates are at an all time low, meaning people can afford to pay more for housing. This in turn will drive prices up in both city and regional areas as the economy picks up.

4. Rental vacancy rates in larger regional areas with good access to the cities, like the N.S.W. Central Coast are already at record lows. The Central Coast is now sitting at a .7% vacancy rate, with groups of 20+ people visiting open homes according to a local agent.

5. Even before COVID-19 there was a positive net migration to regional cities throughout the country, with Sydney losing more people to regional areas than gaining.

This isn’t just our opinion.

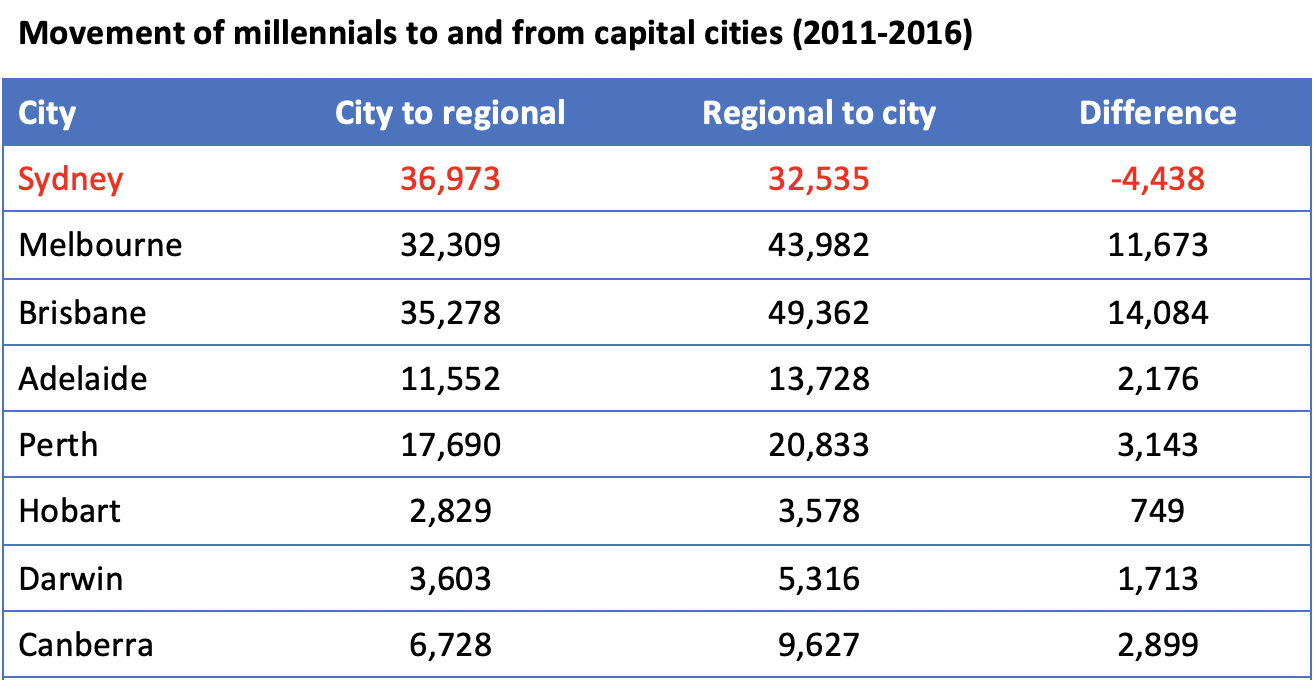

A pre-covid report assessing population trends in Australia showed that even before the work from home renaissance, there was an upward trend in Australians (even millennials) trading in the big smoke for country life. The recently released report “Big Movers: Population Mobility in Australia” tracked internal migration in Australia between 2011 and 2016 and showed a positive migration number of millennials to regional cities as shown below in the table.

Further, the study showed that more than 30% of young people that move to big cities after schooling (presumably in search for opportunities) end up returning to regional areas. This is where the current shift to work from home really comes into play. If the only thing keeping segments of the population is work, and they no longer need to be there, why would they stay?

Experts seem to be on the same page with Simon Pressley, head of research at Propertyology telly Hack "The virus shutdown period is going to be a catalyst for this becoming a serious trend".

Another interesting point that has emerged is the call for large infrastructure projects to help connect regional areas with the big cities. This means two things. Jobs for those living near the projects, and opportunities further afield for those living in the newly connected areas. For example, a high speed train could potentially connect Gosford on the Central Coast, with Central Station in about 25 minutes.

So what to do next?

If you’re in a position to go shopping for property your first step would be to talk to a mortgage broker (click below and we can help with this). Then, we can either guide you on where to look with a personalised plan, or, you can go shopping yourself. If you’re doing the shopping, you will have to start by looking at cities with positive net migration that are within an hour and a half of a major city. Look for infrastructure projects, growth corridors and avoid places that rely heavily on one industry or employment centre (like a mining town). As an extra precaution, you might also look into large retail operations like Westfield, Stockland, Bunnings and Woolworths investing into new commercial buildings. If this seems like a lot of work, it is.

Fortunately, we can help. That’s because we’ve already been doing the research for you! Chances are, if you start this process now by yourself, you’ll miss the boat so either get help or get to it!

Your next step is easy – click the "Get in Touch" link below and we can help you take advantage of this once in a lifetime opportunity.